新入荷

再入荷

数々の賞を受賞 Amazon.com: Option Pricing and Portfolio Optimization 数学

タイムセール

タイムセール

終了まで

00

00

00

999円以上お買上げで送料無料(※)

999円以上お買上げで代引き手数料無料

999円以上お買上げで代引き手数料無料

通販と店舗では販売価格や税表示が異なる場合がございます。また店頭ではすでに品切れの場合もございます。予めご了承ください。

商品詳細情報

| 管理番号 |

新品 :58779152909

中古 :58779152909-1 |

メーカー | 109cbe21a968 | 発売日 | 2025-05-19 01:06 | 定価 | 5890円 | ||

|---|---|---|---|---|---|---|---|---|---|

| カテゴリ | |||||||||

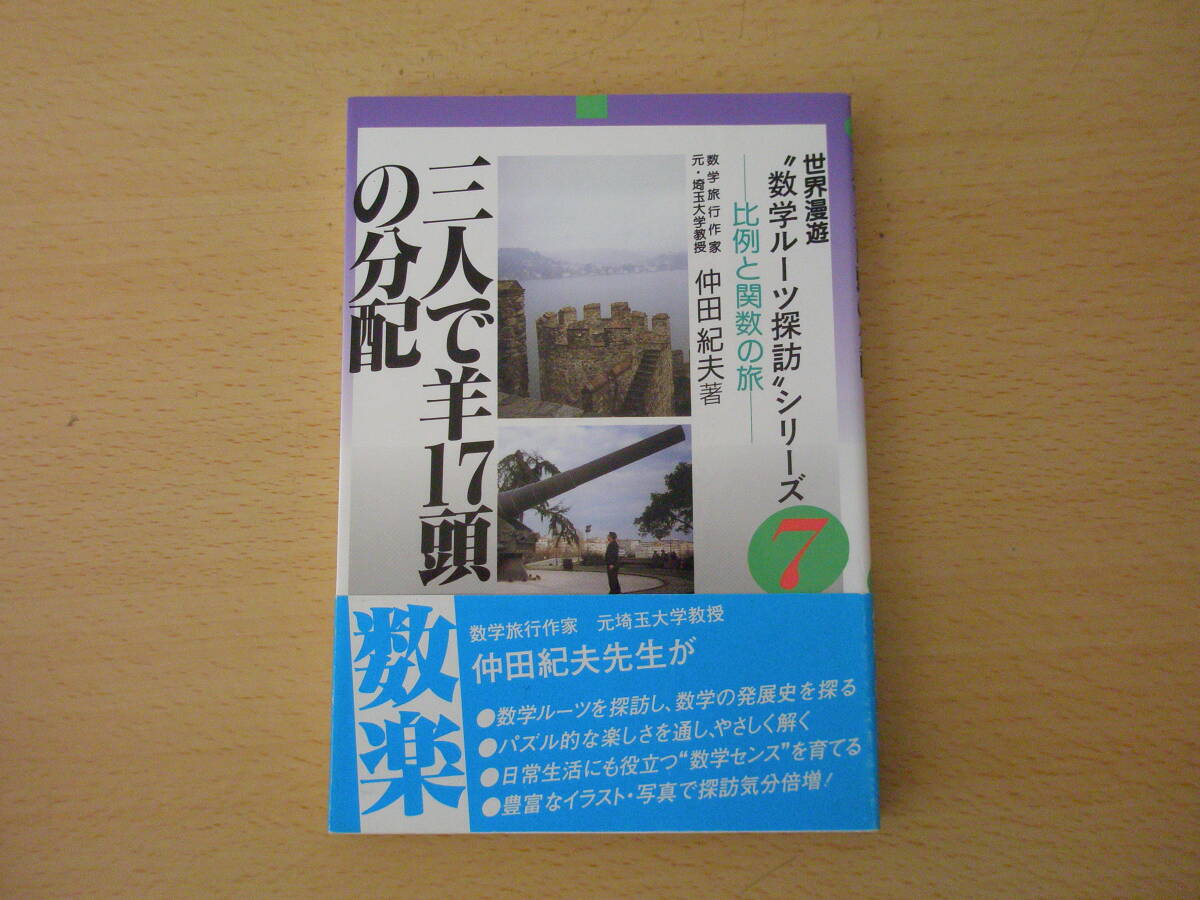

オプション価格設定とポートフォリオ最適化: 金融数学の最新手法 (数学大学院研究)

定価¥ 7,171

発売日2001-01-01 英語版

メーカーAmer Mathematical Society

ASIN: 0821821237

JAN: 9780821821237

小口等に多少のダメージ見られますが中を含め問題ありません。[A01477619]入門 ベイズ統計学 (ファイナンス・ライブラリー 10) 中妻 照雄。

ユーズド品としてご理解いただける方でお願い致します。Dc-318/2色刷デラックス 解法のテクニック 代数・幾何 著者/矢野健太郎 株式会社科学新興社 1982年初版第1刷発行/L6/61011。

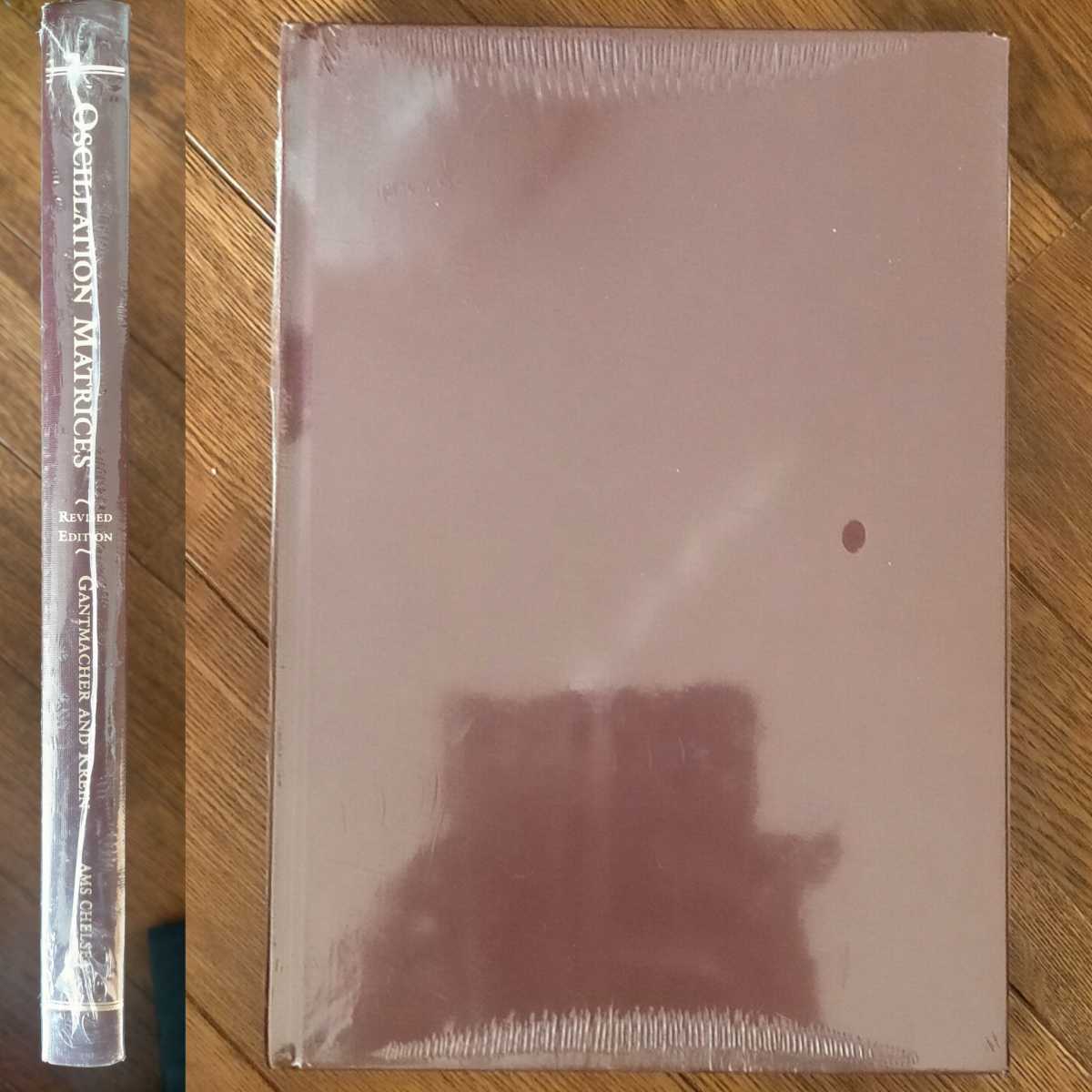

Introduces Ito calculus, concentrating on applications in financial mathematics. Builds the standard diffusion type security market model, then treats the pricing of options in detail, introducing the method of option pricing via replication and no arbitrage. Presents a method of pricing options with partial differential equations, and presents examples of exotic options. Describes basics of Monte Carlo methods, tree methods, and finite difference methods, and deals with the martingale method and the stochastic control method for portfolio optimization. Assumes a previous basic course in probability theory. Author information is not given. Annotation c. Book News, Inc., Portland, OR (booknews.com)